This tactic was first published in the Bankless newsletter and written with advice and support from Ryan.

Link to the original publication

Dear Crypto Natives,

Remember that guy who tried to live on Bitcoin in 2013?

Living bankless was harder back then. No one accepted it. Lots of friction. But people kept saying that one day every Starbucks would accept Bitcoin.

But it didn’t stick.

It’s funny because the guy in that story is now a mega-millionaire much the result of…not spending his Bitcoin!

What does that teach us? It teaches to not to spend our BTC & ETH! Who wants to end up like Bitcoin pizza guy?

But it’s time to check in again. New tools like stablecoins and DeFi protocols are now make going bankless easier…and even…better than a bank?

I asked Brice to share his story. He’s uses an Ethereum address, a few protocols, and a wallet + visa card combo to get passive DeFi income to pay for his lunches.

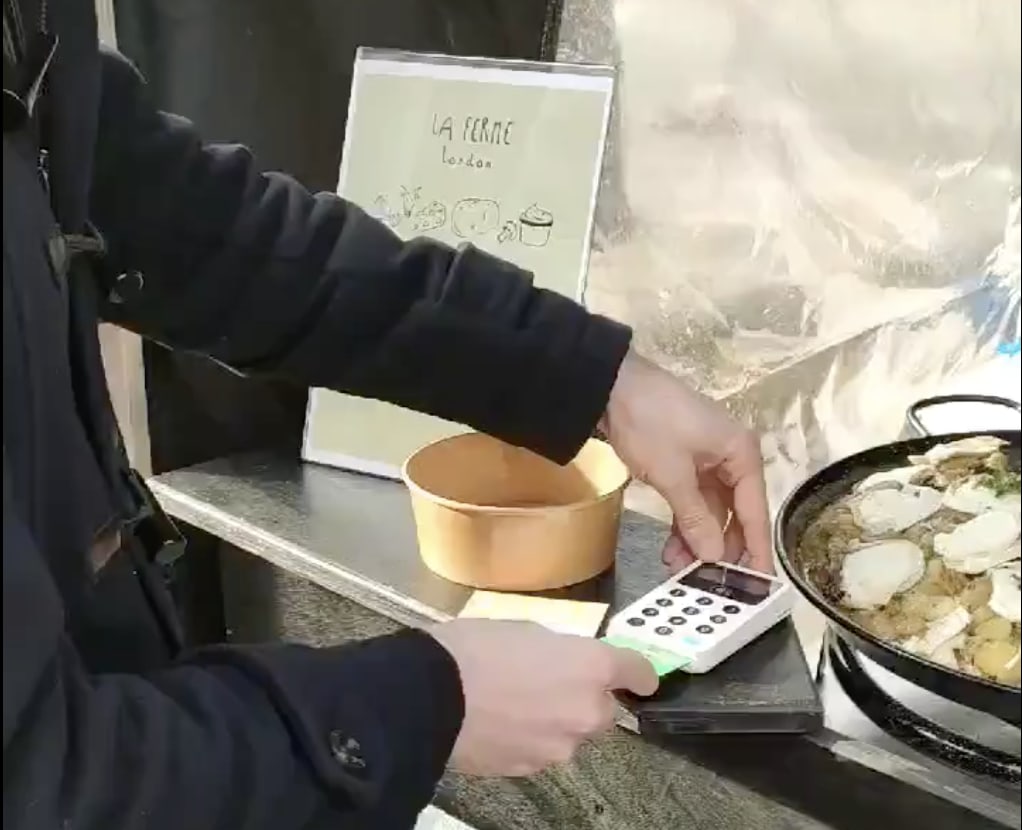

(Above—watch Brice pay for French cheese the bankless way)

And he plans to do a whole lot more!

We’re closer than ever to the dream of a crypto money system yet hardy anyone’s talking about it. They will. The next 10 yrs is where crypto becomes useful in daily life.

This is the decade we go bankless.

Let’s dive in!

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #26: How DeFi can pay for your lunches

Brice tells us his system for earning daily DAI to pay for expenses like lunch. He uses an Ethereum address as his bank, DAI as his stablecoin and savings account, tokenized real-estate to generate passive income, and a smart-contract wallet plus Visa card for spending. Learn about his 5 DAI per day portfolio.

- Goal: Generate a stable return in DAI to cover for living expenses.

- Skill: Intermediate

- Effort: An hour or two a week, sometimes less

- ROI: 9-12% annual if fully passive

⚠️RSA’s note on risk: In this bankless frontier Brice is taking on many risks—to name a few: failure of DAI, failure of protocols like aDAI, failure of smart-contract wallet, variable interest rates, failure of the entire Ethereum protocol. He could lose all or a portion of his funds in a worse case. The passive income opportunities he mentions should be adjusted for these risks.

Guest post: Brice Berdah, Community at Monolith & DeFiFrance Co-Organizer

My relationship with money has always been ambiguous. As a teen, I was your usual “get money it’s spent that day” kind of guy—I wasn’t really thinking or strategic about it, just looking forward to enjoying what money enables.

The masterplan

As I grew up and started earning money on my own, I began thinking more and more about money and personal finance. Shortly after my first proper job, I was already doing math on my expenses, my income, and how long I would need to work and save in order to not have to work anymore. The dream of freedom.

Quickly, this turned into a basic plan with two arbitrary choices:

- I would aim to acquire $1.5M. I assumed this capital would earn 5% / year landing me around $75K/year of interest before taxes—enough to sustain my lifestyle if not too excessive.

- And I’d get there by the time I’m 35 (giving 20-30 good years to do my things)

It was obviously and predictably a failure. Between the start of my plan at 21 years old and now (I’m 28), I was barely able to save a fraction of the required amount.

Why did my plan fail?

As I was learning about decentralised finance, I took some time to reflect on the back-then current failure of my masterplan. Here are the main reasons I identified:

- I did not define steps to reach the end goal: I wanted to jump straight from no passive income to full passive income, without planing any intermediary step to make it more realistic and achievable.

- I had little to no discipline when it came to taming my expenses

- I overlooked the “details”. I had little to no idea of how I was actually going to produce a stable and consistent 5% return on such capital. I just assumed it would be attainable.

Enter decentralised finance

So let’s jump to the current situation! I followed the development of the DeFi ecosystem very closely, thanks to my job at Monolith and the different meetups I co-organise.

At first, I used DeFi out of curiosity: the amount I engaged was marginal—most of my net worth was still in ETH/ERC-20 tokens. Like most, I was both curious and perplexed—is this magic internet money experiment really working?

My “Aha!” moment

I started seriously using more DeFi services, like Compound & bZx and then later the Dai Saving Rate & Aave. It was awesome and magical, but it wasn’t what lit the spark for me.

Nope.

The magic spark came from a piece a tokenised real estate I bought on Ethereum using RealT. You may already know RealT—it’s a platform for tokenized real-estate. You own property tokens and receive daily rental payments in DAI.

Why this? It got my mind racing. This was how it went:

- 1st day of rent: oh okay, this thing is real. By this point, I started discussing RealT with other people in the scene.

- End of first week: now I was checking my wallet balance every morning—seeing the list of rent paid was exhilarating but left me craving more!

- End of first month: at first I spent the DAI almost immediately using my Monolith Visa card. It was so tempting—the DAI sitting there in my wallet, accumulating every day.

- After first month: as the idea of daily DAI became a reality to me, I started rethinking about my masterplan: how much DAI do I need per day to live solely on that? How much capital would it represent? (Hint: way less than $1.5M)

(Above: a DeFi Milkshake I bought with my daily DAI passive income using Visa card)

DAI per day as a framework

What happened there? Why would RealT have this impact on me while Compound did not? (Huge respect for all the projects mentioned in this post, please keep going!)

I think the answer is more straightforward than what people expect:

We used to download movies or buy them to watch them. At some point, Netflix offered us streaming and 99% of us never looked back—I expect the same thing to happen with money.

Money that empowers people

Simply put, daily DAI streaming is a paradigm shift that enables most of us to instantly become much smarter and efficient in the way we relate and manage our assets. It’s empowering to the individual.

Why? The concept of DAI per day reinforces two powerful ideas: first, streaming money and second, using DAI as the base monetary reference.

Why is streaming money a paradigm shift?

- It makes it easy to break down significant objectives in small chunks

- There is no wait time between the first initial investment and the first payout. Payouts are available instantly—and spendable anywhere that accepts Visa

Why is DAI a paradigm shift?

- DAI is a stablecoin—you don’t have to hoard it or worry about daily value lose

- DAI is at a bridge: easy to spend in the real world but also a hop away from all other Ethereum-based assets (including passive income assets like RealT)

- As DeFi grows sources of DAI/day are becoming more numerous and attractive

- Finally, the tokens used for payouts are more diverse (consider liquidity pools). Bringing everything back in DAI/day gives you exhaustive visibility over all your crypto-passive income sources.

That Daily Dai Lifestyle

Enough context, let’s get practical: what can we do today with these shiny new financial levers?

I went back to my masterplan to give it a second try.

This time, instead of going straight for full financial independence, I decided to aim for something more practical. For me, it was straightforward: I have three lunches in London every week, costing me around $30 per week on average.

That means I need roughly 4.3 DAI per day to pay for them.

I could also skip lunch, but I decided to have it for free thanks to DeFi! I’m not there yet but getting close: according to my revised plan, I’ll be getting free lunches by the end of March.

Starting with a 5 DAI per day portfolio

I am currently exploring different possibilities in my portfolio, so let’s consider a simple one: one that nets you 5 DAI per day.

Here’s what you can expect if you want a simple passive DAI strategy:

- 8-9% APR with DAI: for instance, locking your DAI in the DSR is at 8%

- 9-12.5% APR with income assets: but with a higher risk, using RealT

Now that’s if you want to set it and forget about it. There are other opportunities with additional earning opportunities. For instance, if you own a RealT asset, you can:

- Try to sell at a premium on Uniswap

- Benefits from their liquidity incentive program

But let’s keep this simple and passive:

- We’ll stick with the Dai Saving Rate—the safest way to produce DAI interests right now—and RealT—a more risky bet that can offer higher returns

How much in assets values is required for 5 Daily DAI at the below rates?

Going farther

While this is a simple framework to get started it suffers from some limits. For instance, if you’re looking to generate 100 DAI/day from this approach, RealT will not cut it. You’ll run into issues of liquidity (not enough estate available) or systemic risk (you’d be owning a sizeable share of ALL RealT estates).

With my current understanding, I intend to maintain a similar strategy up to roughly 10 DAI/day. My current portfolio also includes aDAI.

As I blast through the 10 DAI/day, this year, that is if the plan stands, I will be diversifying more and more. I think liquidity pools & staking (SNX, for instance) can be a way to go. However, I’m not familiar enough with these topics & haven’t started committing serious amounts of money to it—so I’m not the best one to talk about it right now: maybe in a few months?

Wonder how this looks in practice? See for yourself at tokenbrice.eth.

(Above: see Brice’s DAI earnings & spending in real-time—plug tokenbrice.eth into Zerion)

** On projections…**

Allow me to loop back to my masterplan. While the DAI per day approach is fantastic it has one main downside: it makes yearly projections harder.

Take a minute now and try to guess how much daily DAI you need to produce 50k DAI per year? Did you do it?

How close were you to 137, the actual answer? Most people tend to overestimate.

So while DAI/day is my base, I also look at two other levels to not lose track of the big picture: the DAI per month and the DAI per year.

Going bankless in the real world

I hope you found value in this tactic—my goal is practical DeFi: demonstrating what you can do harnessing DeFi today. This post was written down & translated adaptation of my last talk at DeFi France.

Late last year Mariano Conti’s talk sent an electro-shock to the crypto world: he reminded us that DeFi is already used for very real situations, such as avoiding losing 50% of your net worth to inflation.

It was the perfect demonstration of someone living in the real world using the opportunities offered by DeFi. My goal was to provide the European version of it.

Mariano survived inflation using DeFi.

I, on the opposite, want to live my best life, thanks to DeFi.

Here’s the magic: both of us are acting in our own best interest and in doing so, we are supporting the development of a fairer & more accessible financial system for all.

This is a clear illustration of how fast the industry is evolving: hop on & enjoy the ride!

Author Blub

Brice Berdah is the community manager at Monolith and co-organizer of DeFi France. He’s an active crypto user and leader in the grassroots movement for decentralized finance in the EU.

Action steps

- What are the passive income opportunities in DeFi and what are the risks?

- Get a Visa card for daily DAI spending (Monolith if in EU or other options)

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—[(pay w/ crypto)](