Overview of the passive income-earning opportunities enabled by decentralised finance

Sometimes, it feels like the world of money is upside down: while the returns offered by banks keep getting lower (if not negative!), innovative techs enabled the emergence of an alternative financial system that is already delivering incredible value.

To put it short: Ethereum created money on steroids while regular finance simply fails at delivering anything else than surface-level innovations.

While the money you have sitting at the bank has barely seen a one-digit interest rate for years, the yearly return enabled by decentralised finance frequently prints 2 digits.

How can this situation even be real? It seems like decentralised finance (DeFi) is still a little too intimidating for outsiders. Or more like used to! After reading this, you’ll have no excuse!

I wouldn’t want you scratching your head at the fifth line, so let’s clear the air on DeFi before we go on. Decentralised Finance is a term used to refer to the nascent & novel new financial ecosystem, built on Ethereum.

In this parallel finance ecosystem, thousands of users from around the globe borrow, lend and exchange tokens with one another. They do so using uncensorable and unstoppable services, such as Uniswap.

Free coffees, thanks to strangers from the Internet

Fully harnessing the capabilities of Ethereum, those new financial services are able to (potentially) operate in a decentralised, trustless and transparent manner — making the system more accessible and inclusive overall (no credit check!).

Another key aspect of DeFi is its composability, often referred as “money lego”: projects built using Ethereum’s DeFi follow standards (such as ERC-20 for basic token definitions) enabling “permission-less interoperability” — it’s possible to integrate any project one with the other, without even requiring the help of its creators.

If you are curious about the topic, you’ll find an exhaustive DeFi onboarding guide here that introduces many articles, podcasts and videos to learn more about DeFi.

Now, I know DeFi can be a lot, so I develop a very practical approach to it: we’ll talk only about LIVE, working services that have been paying interests to their users for several months at least.

Earning returns on a stablecoin

ℹ A stablecoin (such as DAI) is a token with stable value. It’s usually achieved by tracking the value of a stable asset, like the dollar: 1 DAI = $1.

The decentralised finance ecosystem is structuring itself as a more credible alternative every day. Strong & resilient services emerged as basic tools used by most:

- Maker: Borrow against ETH

- DAI: Avoid price volatility & earn interest (Dai Saving Rate)

- Uniswap: tokens exchange

- Compound Finance: borrow or lend & earn interest

- Other services exist to produce a passive income thanks to Ethereum, such as RealT, Aave, or bZx.

With the help of these new services, you can:

- Have your assets in $ — DAI is a cryptocurrency tracking the price of $1 — so that you’re not exposed to the markets’ volatility.

- Earn a 5–8% yearly return, on that $: your DAI will either be lent or locked directly in the Maker system (Dai Saving Rate) to help stabilize the price of DAI.

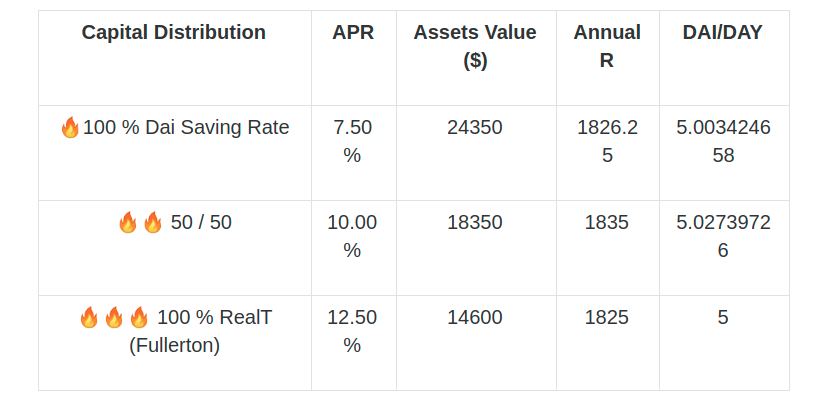

How does a wallet earning 5 DAI/day look like?

To keep it simple here, we’re considering only 3 investments strategy matching different risk profiles, using only two different services:

The Dai Saving Rate is arguably the safest way to earn a return on your DAI. The risk is minimal because you’re not lending your money to anyone. To keep it short, you lock your DAI in the Maker system, and the system pays you a premium because you’re helping DAI to maintain its peg.

🖊 Edit: Please note that the earning rates presented for specific protocols are no longer accurate. However, similar results can still be achieved with alternative methods.

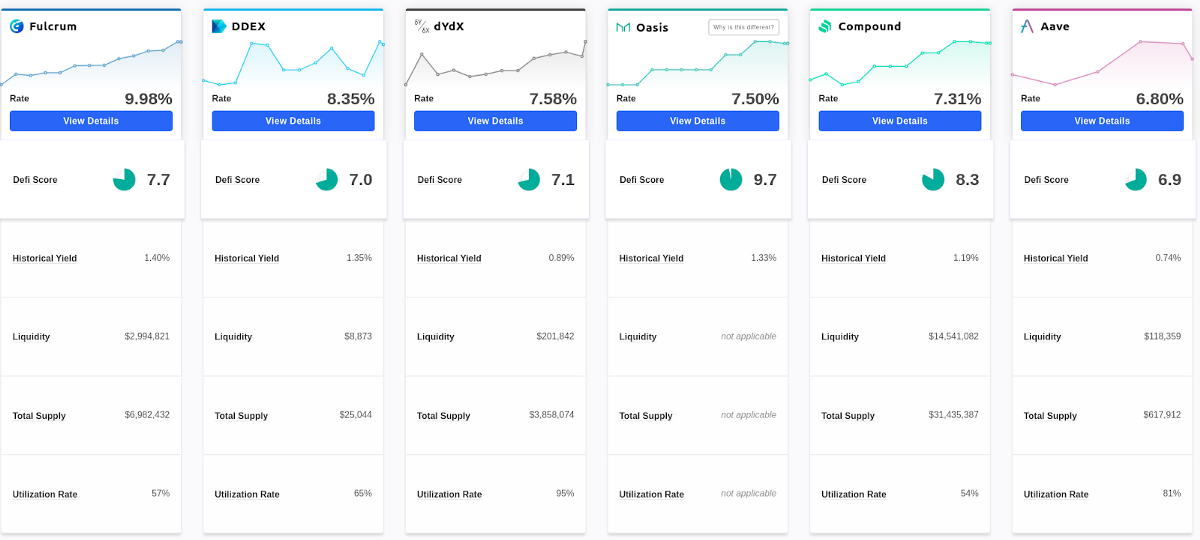

👆 DeFiscore is a community project offering a comprehensive rating of the risks associated with different lending protocols. What you see above is an overview of their ranking of DAI lending opportunities.

👆 DeFiscore is a community project offering a comprehensive rating of the risks associated with different lending protocols. What you see above is an overview of their ranking of DAI lending opportunities.

On the other hand, the other solution used, RealT, is a little more novel and risky. RealT tokenises real estate on Ethereum & allow anyone to become an owner. If you own a share of RealT estate, you’ll receive your share of the rent, paid in DAI, daily.

ℹ Since RealT tokens are securities, you will have to through a KYC to purchase them.

While the level of risk is higher with RealT than Maker, RealT does have one advantage — so far, the returns are stable. On the other hand, Maker’s DSR rate is still changing quite often:

- (Nov 18 2019) DSR Launched at 2%

- ➡ (3 Jan) 4 %

- ➡ (8 Jan) 6 %

- ➡ (26 Jan 2020) 7.75%

- ➡ (4 Feb) 8.75%

- ➡ (9 Feb) 7.5%

From DAI to coffees

Now that we have a clearer picture as to how we can generate a passive income using cryptocurrencies, you might wonder: what about the coffees?

Well, thanks to Monolith (disclaimer: I work there) it’s easy as ABC. We provide you with a non-custodial Ethereum wallet, paired with a Visa Debit Card. You can go from DAI in your wallet to a €/£ balance ready to be spent on your card in 30 seconds.

That was step 1. We’ve shared recently about a significant upcoming update, that will let you exchange tokens and access decentralised lending services straight from your Monolith app:

Before you jump in

If you are seriously considering investing amounts close to those presented in the table above, please ensure that you know the basics: such as using & securing an Ethereum wallet, understanding threats and choosing an appropriate security model.

You do not need an account on any exchange to use DeFi. It is much safer to access DeFi services directly from your wallet. Using a centralised service generates additional risks for your assets.

Ready to make the jump? Deploy your first contract wallet today and order your Visa debit card with the Monolith app.

DISCLAIMER

This article represents my personal view only — and is written free of any professional affiliation. Facts & data are sourced as much as possible, but my views are my own.

It does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any cryptocurrency, digital token, investment, security or any other product or service.

Furthermore, nothing in this article is intended to provide legal or investment advice and nothing in this article should be construed as a recommendation to buy, sell, or hold any cryptocurrency, digital token, investment or security, or to engage in any investment strategy or financial transaction.