“Non-fungibles” — don’t let yourself be fooled by the mushroom-evoking name, fungibility is an old concept that is finding a second wind nowadays. It’s mostly about collectibles and video games for now, but it will soon outgrow these industries. Indeed, the potential of non-fungibles tokens is much more significant than this: from official documents to titles of ownership, their use cases are diverse and numerous.

Let’s start by establishing the basics about non-fungible tokens (NFTs from now on) thanks to Pokémon cards before we dive into their potential use cases and the future developments of the underlying technology.

Tokens? Smart Contracts?

Before we explore NFTs and talk about Pokémons, let’s restate two definitions necessary to understand the rest of the article:

- Smart Contracts: A smart contract is a computer protocol intended to digitally facilitate, verify, or enforce the negotiation or performance of a contract.

- Token: a token represents a particular tradable asset or a utility that is often found on a blockchain. Each token has specific properties that are defined to match its usage.

SO, what does fungibility even mean?

A fungible good is a good defined by its belonging to a type: different units of fungible goods are interchangeable. “Fungibility,” as a concept, is used in several different academic disciplines; we’re addressing the economic definition only.

Let’s jump to the examples which make the concept much easier to understand. Our modern currencies, such as the dollar, are fungible: one $5 bill can be exchanged with another. Gold is also a fungible good: 1 ounce of (pure) gold is worth another.

A fungible good is standardized: each unit of this good has no uniqueness, which is why we can exchange them with one another.

What about non-fungible goods then? Can we still eat them?

Some goods are non-fungibles. They are goods which share common attributes but have their uniqueness: each good has a unique set of values for each trait which is shared with the whole type.

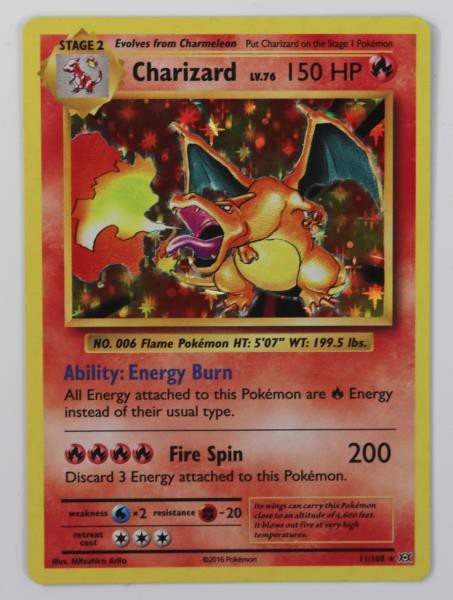

The best example of non-fungible goods are… Pokemon cards of course! While we’re at it, let’s pick the one that used to be enough to crown you king of the playground: Charizard himself.

A Pokémon card is made of:

- A name (and a level): Charizard, level 76,

- Health Points (HP): 150,

- A type: fire,

- An ability: Energy Burn,

- An attack and its cost: Fire Spin (4 fire energies),

- Weakness and Resistance: water and fighting,

- A retreat cost: 3.

Each Pokémon card is unique, but all follow this typology.

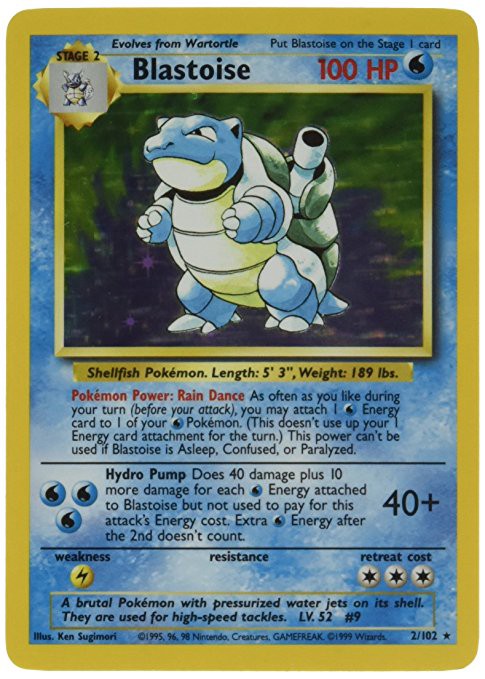

Let’s consider Blastoise for instance: he too has the 7 attributes we have already described, but he has different values for each which make him different from Charizard and unique.

It’s the combination of the value for all the attributes that make the cards’ uniqueness. Hence, a card describing a fire type Pokémon with 150HP is not a Charizard — it is merely a card with 2 attributes equal to those of Charizard, out of 7.

Pokémon cards are useful because they make most of the concept of non-fungibility easy to grasp. NFTs are a category of tokens that share common attributes. But each token has a set of unique values for these attributes which make the token itself unique.

If you were too young for Pokémon cards, or too old, it’s precisely the same principle for other card games: Magic, Yu-Gi-Oh !, World of Warcraft (the card game) and others.

Fungibility applied to cryptocurrencies

Most of the cryptocurrencies you already know such as Bitcoin or Ethereum can be considered fungible (see below ⬇️). One BTC is worth another and two BTC can be exchanged with one another. It’s the same for all cryptocurrencies you could find on Coinmarketcap.

Since the history of transactions of most cryptocurrencies can be checked on block explorers, some tokens involved in illicit activity are flagged and blocked on exchanges. Therefore, cryptocurrencies with public transaction histories are not truly fungible. Full fungibility is currently achieved by privacy-focused coins such as Monero, because the transaction history is not publicly disclosed.

We won’t address these today, as we focus on non-fungible tokens. There were several attempts, as early as 2013 to create NFTs, but they were mostly unsuccessful. What made a difference was a new Ethereum standard, the ERC-721 which greatly facilitated the creation of “cryptocollectibles.” They are unique goods which share common attributes — the blockchain equivalent of Pokémon cards.

The humble beginnings powered by the ERC-721

Cryptokitties is what made NFTs known to the general audience — they are virtual kittens which were the precursors of the ERC-721.

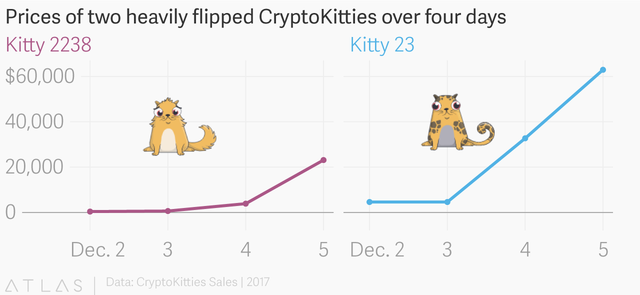

The project went live in October and took a couple month to reach its peak of virality last December. Cryptokitties were such as success than the whole Ethereum network was clogged for several days by the flood of transactions.

Specific kittens, the most desirable of the bunch, reached prices in the 5 digits ($) and changed hands several times in a few days early December. Considering the success of the CryptoKitties, the ERC-721 went through the due diligence to get approved and finalized last June.

Non-fungible tokens in the everyday life

When it comes to pushing and improving new technologies, you’ll often find porn and video games sharing the front line.

Right now, collectible and video games are at the forefront of the innovation. Indeed, when it comes to pushing and improving new technologies, you’ll often find porn and video games sharing the front line.

However, the real-world applications of NFTs are very diverse, numerous, and much closer than we think. Thanks to their characteristics, NFTs can be an excellent support for the tokenization of real-life goods.

Tokenize means creating a token representing a good. The token by itself has no value; it draws its value from the good it represents.

Tokenize everything!

Tokenization allows to handle goods like tokens which open a wide range of possibilities: exchange, P2P transferring, fractional ownership (0.x), etc. Besides, other features can be added depending on the tokenized goods: list of the previous owners, history of the value of the good, exhaustive list of the goods’ characteristics, limitations of ownership…

Once the benefits of tokenization are understood, we realize that tokenizing real goods will let us spare ourselves the need for greedy intermediaries while getting many exciting new features.

- Tokenization of real estate => who need notaries?

- Tokenization of pieces of art => auctioneers and several other jobs would see their utility and even their existence challenged.

- Tokenization of official documents (IDs for instance) => a substantial cleanup in the actors and institutions currently involved in their emission, as well as those in charge of detecting and preventing frauds.

In the three scenarios detailed above, checking the authenticity of these goods as well as making sure their owner is indeed the real owner of the good would be much easier than now.

The benefits of disintermediation thanks to tokenization

Tokenization is much bigger than creating a token to represent a real-world good. Let’s come back to the definition of NFTs we proposed: “unique goods which share common attributes.”

So tokenization would work as well for certificates. IDs, passports, report cards or even software license could be tokenized. Not only would it greatly facilitate the process of emitting and sharing them; it would also provide traceability, unlike anything we’ve ever known so far. Which in turns would make a 99.9% fraud detection and prevention goal a realistic one.

If we keep pushing the logic further, we could go back to the digital world and envision NFTs to store our digital identity. Our social network profiles could be open-source and easily exportable from one network to the others. Besides, it would give full control and ownership over our own data and prevent malicious third parties from stealing them.

Before we get there, we need to overcome the current limitations of both the Ethereum network and non-fungible tokens: as stated before, the CryptoKitties were enough to clog the whole Ethereum network for several days. The current state of the tech (or December’s state at least) is apparently insufficient for a large scale usage.

ERCs — The new standards of the Ethereum network

Regarding the Ethereum network, several teams are already working on the technical optimization of the network. Among them, we could mention Omisego/Plasma or the upcoming Ethereum update (Casper). Check the sources at the end of the article for resources on these matters; today we’re talking about NFTs so let’s get back to it.

The ERC-721 was a good start yet it faces many problems while going at scale. Before we get here, let’s zoom in on ERCs. An ERC (Ethereum Request for Comment) is a proposal submitted by an Ethereum developer. It introduces methods, behaviors, innovations or research that could be used to used to improve the network functionality. Once accepted, an ERC can become a standard — it’s quite a long process. Once again an example makes the concept much clearer: the most famous standard for Ethereum is the ERC-20. It described a fungible and straightforward token.

The primary interest of ERCs is that they allow integrating the tokens within the ecosystem smoothly: there is no need to know the specifics of each token since they follow a set of methods shared with others (defined by the ERC). This is why a wallet which supports ERC-20 tokens support all of them without requiring particular development for each new one.

ERC-1155, the future of non-fungible tokens?

The ERC-1155 is a new standard for NFTs proposed by Witek Radomski, the founder of EnjinCoin, a platform made to facilitate the development of games with tokenized goods on the Ethereum network.

The ERC-1155 fixes many issues raised when trying to use NFTs based on the ERC-721 at scale, and also brings many new features. Regarding the technical optimization, the ERC-1155 allows sharing a given piece of code between several different tokens or collections of non-fungible tokens. It will enable to support a much higher volume of transactions for the same load on the Ethereum network (compared to the ERC-721).

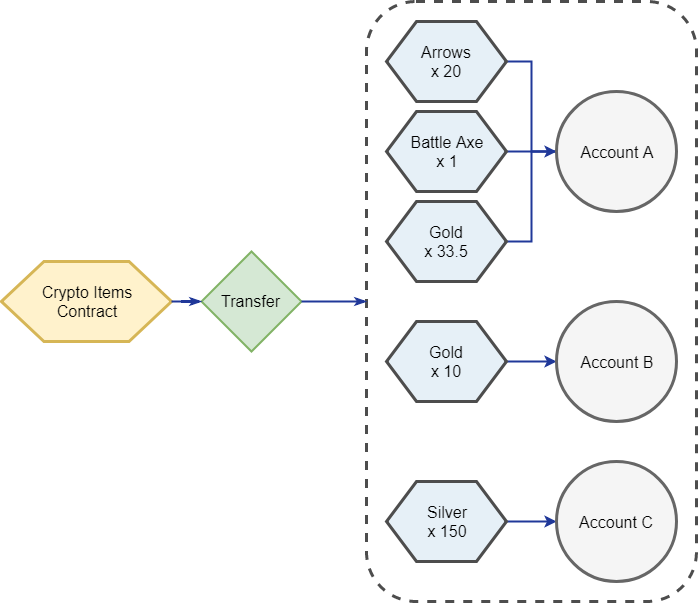

A transaction involving several fungible and non-fungible goods thanks to ERC-1155

A transaction involving several fungible and non-fungible goods thanks to ERC-1155

Using ERC-1155, it’s also possible to exchange several items in one single transaction. With ERC-721, if Bob wants to exchange its cryptokitties #1, #2, #3 and #4 for Alice’s Cryptokitty #5, it would require 5 different transactions while one would be enough using ERC-1155.

The ERC-1155 also supports fungibles goods which are plenty in online games: think about all the coins, potions, arrows and other consumables. Using only one standard, the ERC-1155, versus a mix of them (ERC-721 for non-fungible goods and ERC-20 for fungible goods) makes it much easier for developers.

Finally, ERC-1155 could treat NFTs in a group, allowing them to retain some fungibility. It would allow players to differentiation the different iteration of a same common object, and the first owner of it could prove he was indeed the first to own it.

Conclusion

Non-fungible goods are taking off, and Ethereum is a the forefront of the innovation. To better understand the ramifications of this concept, it’s best to go check its current usages. Let’s have a look at some games being developed/already available in pre-release versions:

Gods Unchained

Gods Unchained

- Gods Unchained: We used card games to introduce the concept, it’s only logical to find one here. Gods Unchained is among the most well-known one and uses the ERC-721 standard. The benefits compared to regular card games (such as Hearthstone) are numerous: immutability of the cards after the release (no more surprise nerfs), full transparency of the rarity of each type of cards, traceability of the previous owners of a given card… The team is focusing on eSports, and the first world championship will take place early 2019.

- Decentraland: Take Minecraft, in virtual reality with blockchain-based mechanisms to handle ownerships: Welcome in today’s Tomorrowland! Once they own a piece of virtual land, users can create/develop the experience of their choosing (thanks to the SDK); they will then be able to control the access to their land and make other users pay for it if they want. Decentraland is a human and social experiment at world scale. It will be seriously insightful!

A creature of Augmentors

A creature of Augmentors

- Augmentors: Since we were talking Pokémon earlier, what about Pokémon GO? Augmentors combined Augmented Reality with blockchain to offer a game where NFTs allow each user to truly own their augmented reality creatures and trade them as they want.

Dismissing NFTs could be tempting as for now it could appear like something for kids and nerds. Yet, it’s precisely the opposite: as the CryptoKitties have demonstrated it, NFTs are one of the best Trojan horses to drive the mainstream adoption of cryptocurrencies and decentralization-based mechanisms.

With new technologies, the technical development is only the warming up phase. The real challenge lies with the social and legal acceptance of the tech: on that front, CryptoKitties and other collectibles are precursors.

This article is the translation of an original (French) EcoCrypto.fr story.

Sources / Deep Dive

- Mapping the Emerging Non-Fungible Token Landscape — Pawel Chudzinski on Medium, 06/15/2018.

- ERC-721 Ethereum standard confirmed and finalized! — 0xcert on Medium, 06/24/2018.

- _Porn Drives Tech Innovation Again, This Time In VR _— Jarone Ashkenazi on the HuffPost, 10/31/2017.

- Explained: Ethereum Plasma— Lukas Schor on Medium/ArgonGroup, 05/28/2018.

- Ethereum Casper 101 — Jon Choi on Medium, le 10/22/2017.

- A Proposal To Shake Up Ethereum — A New Standard On The Horizon? Mapping the Emerging Non-Fungible Token Landscape — Ermos Kyriakides on HackerNoon, 06/27/2018.