Knowing the audience is the key to successful content; it’s the key to successful marketing itself. Yet, for a start-up and moreover at an early stage, it’s damn hard. I tried a lot of different tools before finding the one I’m happy with.

The theory is known, and well documented online: the Skycrapper Technique is now commonplace. Yet, I find that jumping from theory to field tests and implementation is probably the toughest step.

Explaining SEO - Source: webconfs.com | Check it out for more SEO-related comics

Explaining SEO - Source: webconfs.com | Check it out for more SEO-related comics

I’ll walk your through the basics of exploring an industry using a mix of free and paid tools in order find content ideas and insights to improve your web presence. To make it less abstract, I’ll use insights gathered with SEMRush on the telecommunications industry, during the March-April 2017 period to demonstrate my case.

Exploring and analyzing SEO strategies

The SEO Arms race

In order to spot top organic performing content, you’ll need tools. Some free tools can do, but you’ll find yourself using dozens of them in order to match the possibilities offered on a premium SEO service.

When I was looking for my SEO all-in-one dream tool, I put MozPro and SEMRush to the test for a month since both offer a free trial. To sum it in one sentence, the difference between the two lies in the accessibility versus exhaustivity dilemma. While MozPro is easy to on board, SEMRush can be intimidating; yet it offers more features and add new ones at an impressive rate.

SEMRush was particularly useful to track the results of your SEO efforts, be it search position or backlinks. Its usefulness doesn’t stop here as you can use SEMRush on any domain. Looking at competitors’ metrics helps to discover opportunities and to confirm hunches you may have on potential strategies.

The true value of SEMRush to me lies in two things. First, it does in one single tool what would require 15+ free tools. Also, the data given by free tools won’t be as detailed, precise, and easy to access. Second, the depth and the scope of the data provided is arguably unmatched by other paid services and nonexistent in free services.

Before we dig into the Rolls Royce, let’s see how far some free tools can get you.

Free SEO tools and services

The sheer amount of tools, web-services, chrome extensions and such made for SEO and Content is overwhelming. The following tools list is just a partial, and ultimately biased selection that should help you get started:

The essentials toolbox

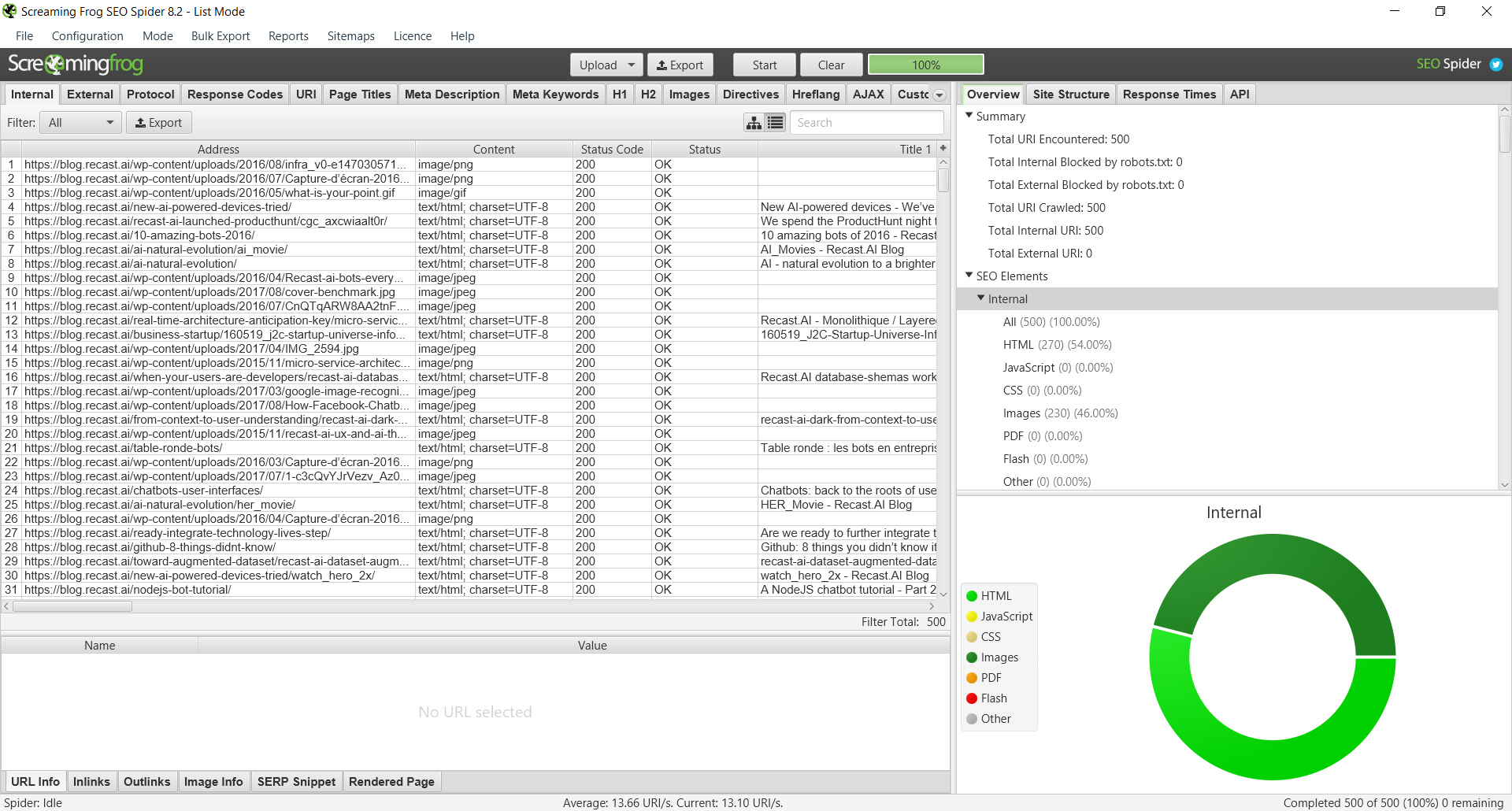

Checking a blog sitemap (Screaming Frog)

Checking a blog sitemap (Screaming Frog)

- Screaming Frog SEO Spider: It’s a swiss-army knife tool, used for anything from finding broken links to checking for duplicate content or analyzing pages titles and meta descriptions. It’s one of the few free tools I find myself using frequently, even when I have access to a premium tool.

- Alexa Ranking: Very basic, but it still gives you an idea of the current traffic flow to a given website and its recent trends.

- Spyfu — This tool is very valuable to get an idea for the AdWords strategy of your competition, including CPC, keyword and creatives.

- Dareboost: Check your websites and your competitors for web performance, security and on-page SEO optimizations.

Keyword Exploration

- Google Keyword Planner — very useful tool for keyword discovery and CPC/volume estimations. You can also mix and match words to produce new keywords.

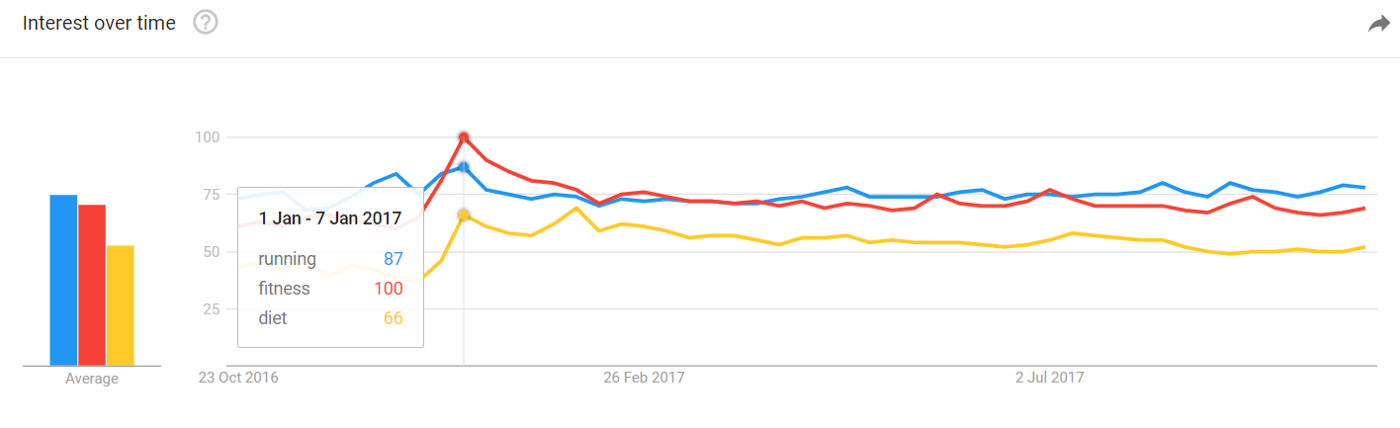

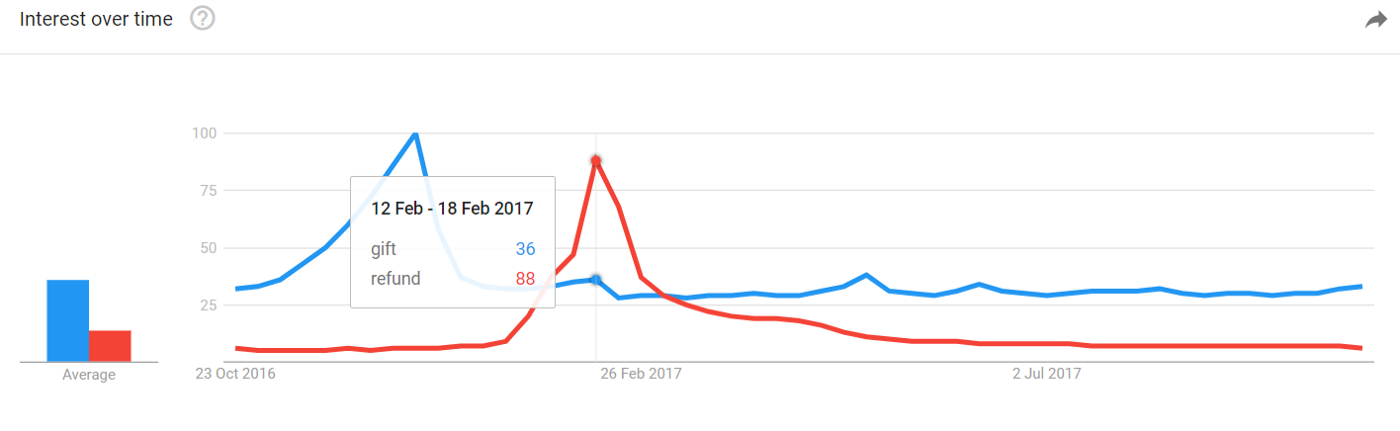

- Google Trends — easily compare volumes between different keywords, see data on volume such as interest over time, where are the search made, or related topics and queries. + Google Trends Correlate — Find keywords correlated to yours. Here are two Google Trends I like to use to showcase the potent of the tool: queries on “running”, “fitness” and “diet” (with the New Year’s Eve impact) and queries on “gift” and “present” (with Christmas’ impact).

A somehow famous Google Trends: volume on “running”, “fitness” and “diet” reaches its peak just after New Year’s Eve

A somehow famous Google Trends: volume on “running”, “fitness” and “diet” reaches its peak just after New Year’s Eve A similar dynamics is observed for “gift” and “refund”. “Gift” peaks a week before Christmas while “Refund” peaks mid-February.

A similar dynamics is observed for “gift” and “refund”. “Gift” peaks a week before Christmas while “Refund” peaks mid-February.

Google Trends is one of the most basic tool there is, yet it can give you invaluable insights. Trends are strongly correlated with the real world and now used for literally anything such as to estimate prices evolution of cryptocurrencies, measure volume distribution for similar keywords, or gauge the efficiency of political communications.

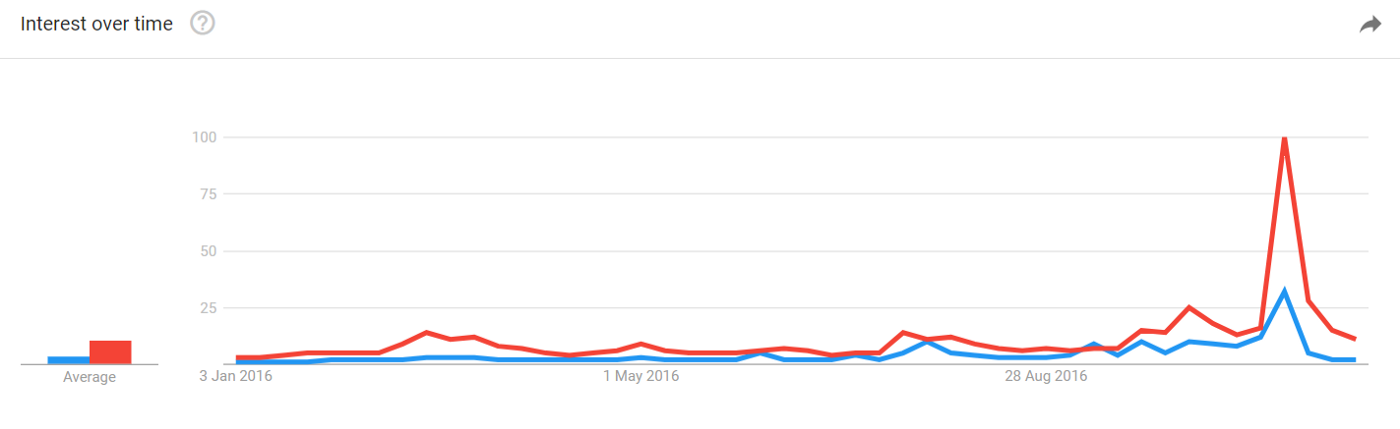

Here’s a last one with Hillary vs Trump over the last 9 months of the campaign. Ignoring the massive spike on the Election Day, Trump was consistently generating more volume that Hillary months before the election. Even if the election was a surprise to most, the data doesn’t lie: it clearly hinted a Trump victory for a long-time before he was elected.

Searches about Hillary and Trump, between the 01/01/2016 and the 11/30/2016 (the election was the 8)

Searches about Hillary and Trump, between the 01/01/2016 and the 11/30/2016 (the election was the 8)

- Ubersuggest — Find new keywords with suggestions based on one keyword.

- Keywordin’s Keyword Generator — Mix and match different words or groups of words together to create more long trend variations of your keywords.

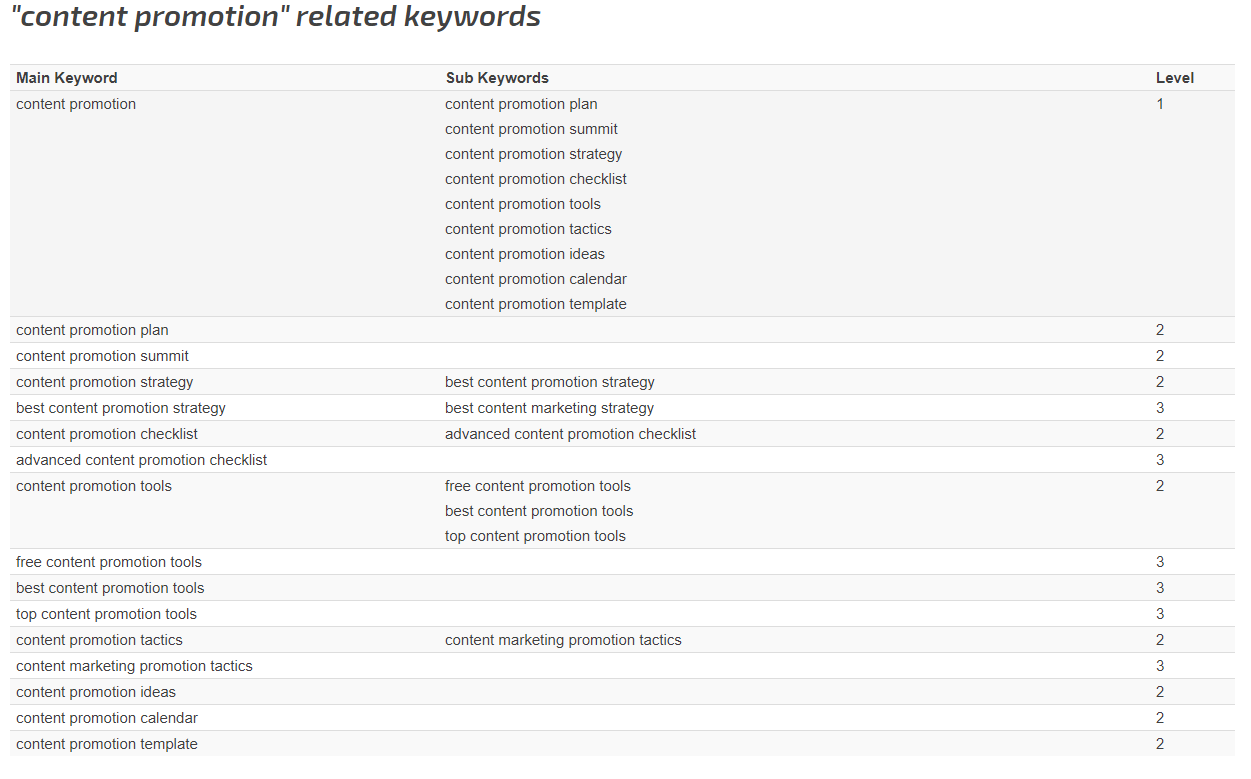

Level 1/2/3 related keywords for “content promotion” using SEOChat

Level 1/2/3 related keywords for “content promotion” using SEOChat

- SEOChat Related Keyword — Find level 1/2/3 (long trend) related keywords based on one given keyword.

SEMRush insights’

For the sake of this article, I’ll show what kind of insights a premium tool can land. The insights presented below were gathered using SEMRush ($99/m) during the March-April 2017 period.

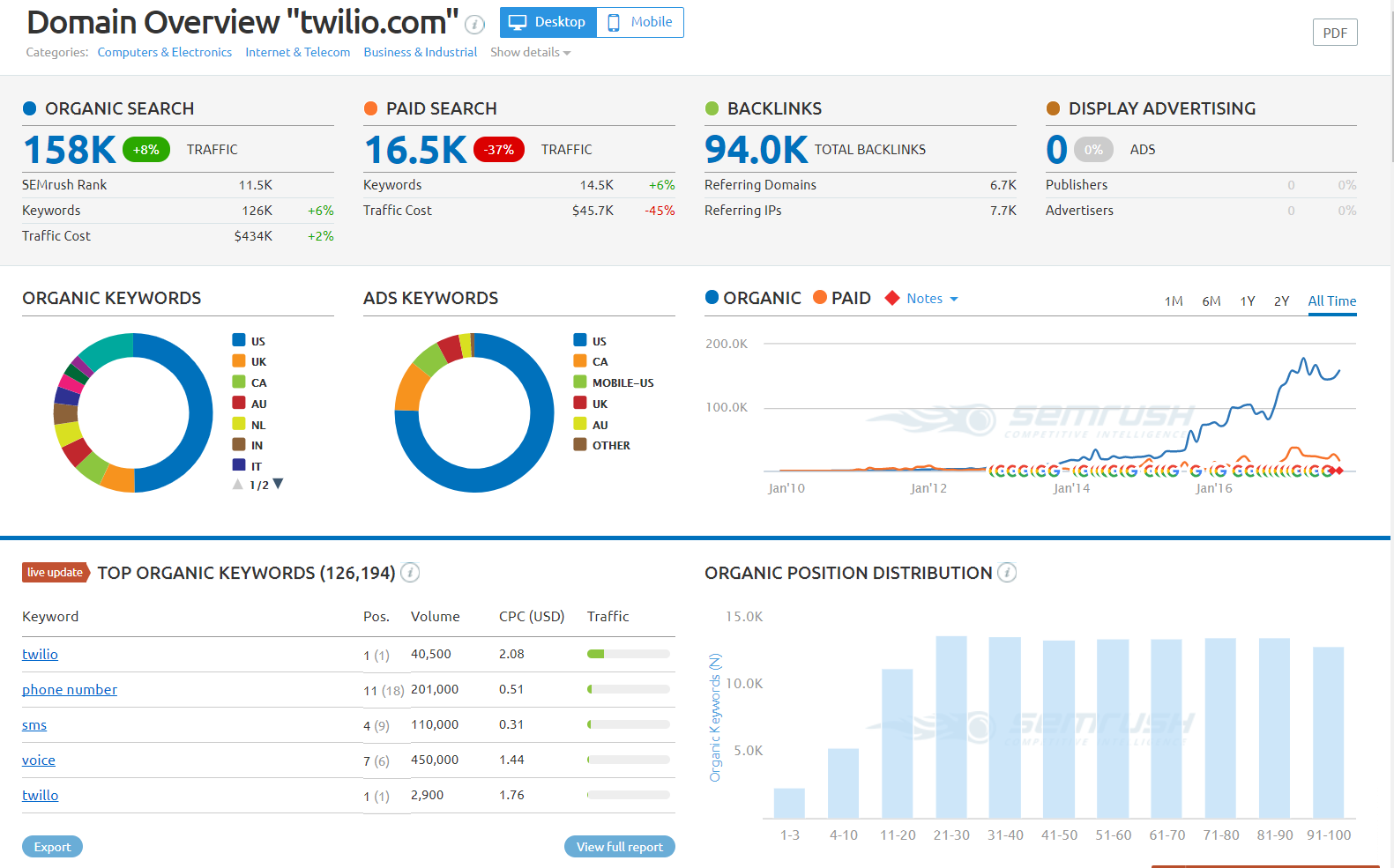

SEMRush works as an “SEO search engine”. In the top bar, you can input any domains (yours or competition’s) and get precise metrics on it including backlinks, top keywords, paid vs organic distribution… Here’s how it looks like on a sample domain query (twilio.com):

Domain overview for twilio.com (SEMRush)

Domain overview for twilio.com (SEMRush)

The domain overview include metrics about backlinks, their types, anchors… Every entry is accessible in a dedicated and exportable full report.

Backclink section of Twilio’s domain overview (SEMRush)

Backclink section of Twilio’s domain overview (SEMRush)

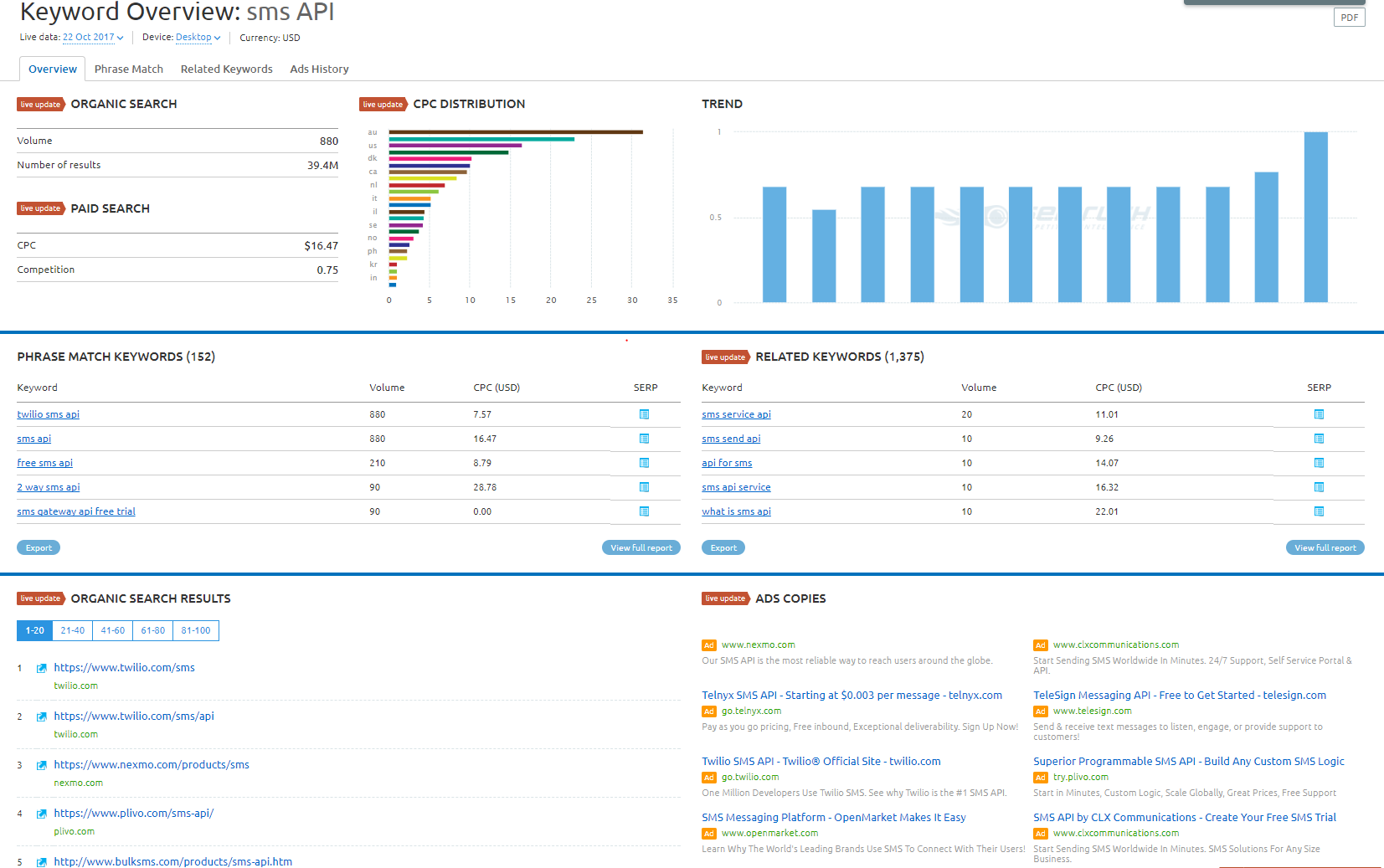

You can also search keywords. The overview tab will give you data about organic and paid volumes, search results and copies. Two other tabs are dedicated to keywords: phrase match and related keywords. The amount if data available on any keyword is really vast, this where SEMRush shines; as long as the search volume is sufficient.

Keyword overview for “SMS API”: Twilio is clearly dominating for now (SEMRush)

Keyword overview for “SMS API”: Twilio is clearly dominating for now (SEMRush)

Together, the tools provided by SEMRush let you conduct true surveys of your competitors’ digital activities and estimate the success of their strategies.

Below is a quick overview of the insights gathered during the first round of competitor’s analysis for CALLR, a voice and SMS API and SIP Trunking provider (03–28–2017) using SEMRush.

A voice and SMS API essentially allows computers to interact directly with phone networks. Services such as Twilio’s, CALLR’s, or Nexmo’s are behind the text messages you get to confirm your authentication on websites (2FA), the notification texts you can get from services such as Uber or Amazon, etc. and many other use cases involving automated phone calls and text messages.

- Over 12% of Twilio’s organic traffic comes from a single article, not strongly related to their expertise. Indeed, it’s a tutorial detailing how to handle (read and write) Google Sheets with Python. 12% of Twilio’s organic entries is around 15K monthly sessions according to SEMRush. It could be surprising but it makes sense: people using Voice/SMS APIs find themselves interacting with huge sheets quite often, contact lists for instance.

- About 10% of Sinch’s organic traffic come from keywords related (or matching) flash call, one of the business use case they put forward. ~38% of their organic traffic lands on their tutorials.

- Still on Sinch, 41/500 of their top queries were due to an extensive tutorial (with 700+ comments) on how to build a messaging app on Android. Now the page returns a 404.

- Nexmo’s present a sensibly different organic traffic profile than the rest of the competition. While most providers get the bulk of their organic search traffic from brand or even exact query, Nexmo’s top entry points are their products pages, especially the SMS page (25% of organic sessions) and Chat app page (another 12%). At CALLR, we studied them extensively.

- The American competitor CallFire is deploying a smart strategy to increase their organic presence. They have seemingly auto-generated page to match every US area code. A large part of their traffic comes from people looking for “XXX area code”. Conversion on this traffic must be low though.

As you can see, SEMRush helps you find an already field-tested, working strategy used by your competitors. While your chances of achieving the same success by purely replicating them are slim, it gives you an idea of what works in the industry and what people are looking for. Just as a note, it’s the first time I share this unexploited list, and even though the tips are 6 months old, they might still be valid.

On the list above, the first one I would address would be Sinch 404’s as it’s the most straightforward: your job would be to produce a tutorial on the same topic, better than Sinch, and then reach out to all those who still links to Sinch’s 404 to offer your own tutorial instead.

Even if the page is now a 404, using the Internet Archive you can still access the original tutorial to see what you’ll have to overtake.

You can try both SEMRush and MozPro for free to make up your mind. MozPro offers a free one month trial and you can get a free trial of SEMRush.

Finding content performing on social network with BuzzSumo

BuzzSumo is a social analytics and monitoring tool. Before I dig in, it’s time for a disclaimer. BuzzSumo is $99/month with a 14-days free trial. Because of the price, I decided to opt out of it, but I did use it for the duration of the free trial. It helped me get a better understanding of the dynamics in my industry.

Considering my limited experience with the tool, I won’t go into too much depths. If you’re considering paying for BuzzSumo and using it extensively, I recommend you to read these comprehensive resources: Raelyn Tan’s BuzzSumo tutorial, BuzzSumo’s team itself densely document its product.

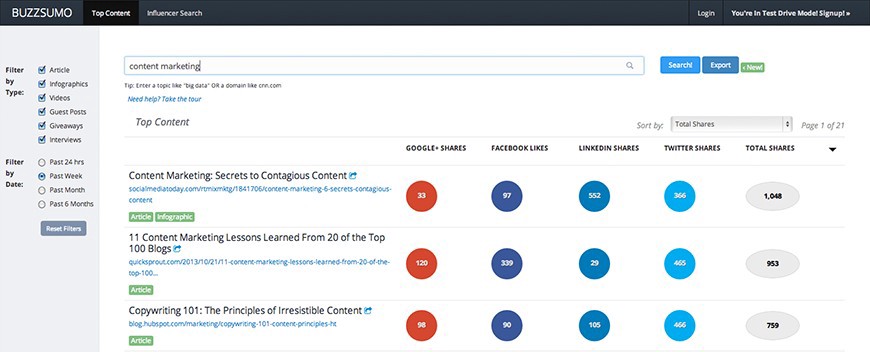

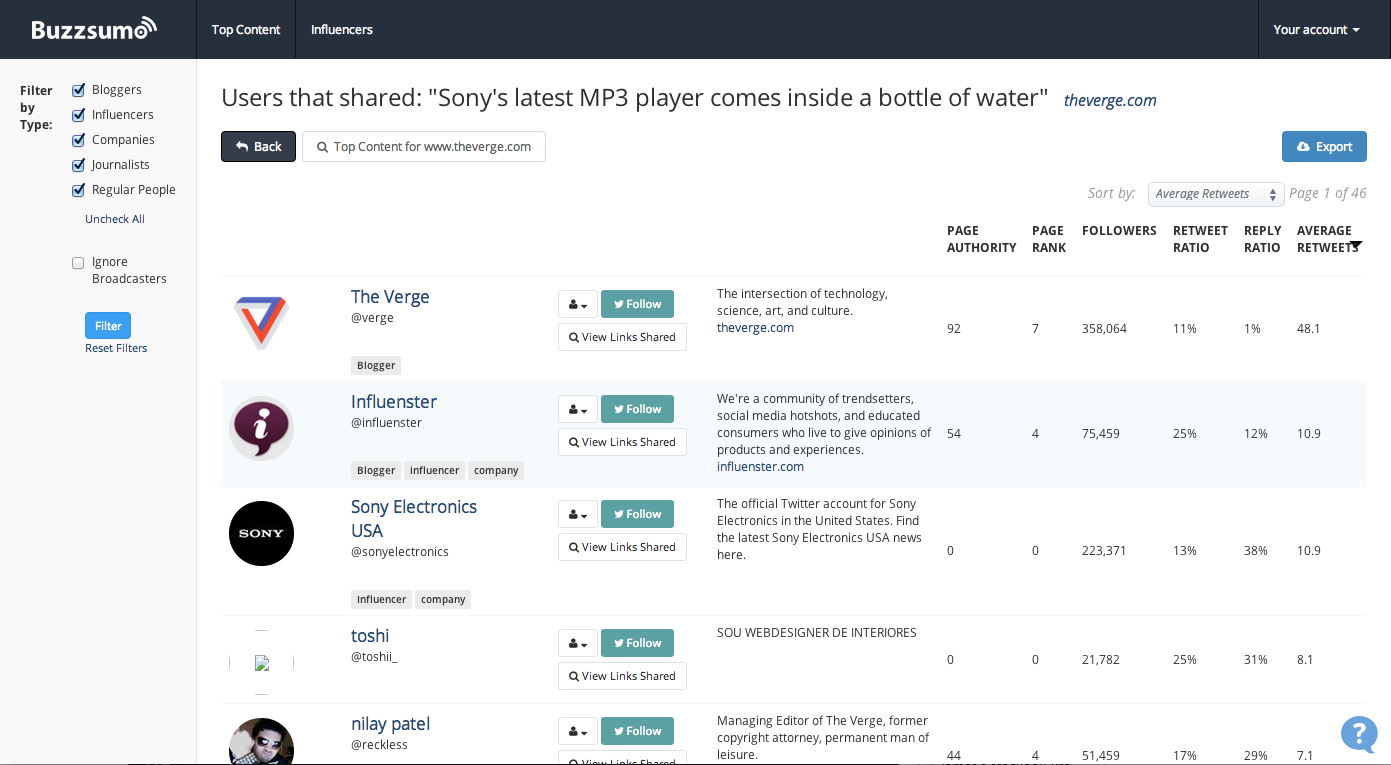

You can search for topics or keywords and see the most shared (social) content. You can go even further and see, for any given post, the accounts who shared it allowing you to understand how each post got its reach. This is also particularly useful is you are publishing similar content: it gives you a list of people potentially interested in sharing it.

The results of a search on BuzzSumo

The results of a search on BuzzSumo

I set up the BuzzSumo trial in February, to find the top-content addressing VoIP, SIP, and telco APIs. Back then, I recently joined CALLR and was in a reading spree to get a better hang of the main themes to address. Thanks to BuzzSumo, I compiled a list of the top-performing content of the industry. I sorted them according to varied factors: topics, quality of content, approach, tone, targeted audience… Then, looking at sharers, I tried to correlate these factors to the article’s performance.

BuzzSumo’s main strength is that it’s a must-have tool if you want to use the skyscraper technique. It facilitates the process of finding people potentially interested by your content. Indeed, BuzzSumo’s main strength is that it lets you see the list of sharers of a given content.

Preview of the sharer list feature

Preview of the sharer list feature

Yet, the metrics it gives you can be hard to interpret. For instance, in the telco industry I found basic heavily-shared 500–1000 words articles, sometime even just basic product pages from competitors, not particularly qualitative. The gist? Most of these shares are on LinkedIn, and it turns out a lot of these shares comes from the company’s own employees. If a 2000+ employees company manage to get them to share their own content, it can really skew the results.

My advice with BuzzSumo is to dig deeper. Don’t stop at what BuzzSumo gives you. This is also part of the reason I decided to not subscribe to it: it facilitates the research of content performing on social and influencers, but it’s not sufficient by itself as it relies on indicators that are easily fooled (shares, likes and such are easily bought or automated).

From theory to practice

As you can see, the most actionable insights are sadly gated behind heavily priced tools. While BuzzSumo has its flaws due to the shaky nature of social media, it can prove itself useful from a company investing on social medias. On the other hand, a SEO/SEM tool seems to be a must have for any business in for the long-haul, looking to build a durable online presence. Whatever tool you choose, you’re essentially looking for two major benefits:

- 1/ Ability to fetch SEO and SEM data on your competitors / partners / any 3rd party website.

- 2/ Greater tracking capabilities of your own and competitors domains metrics and content performance.

If you are just looking to facilitate your tracking efforts, there are some tools cheaper than SEMRush or MozPro. For simple keyword position tracking, check SERPLAB offering free version with the paid version starting at $5/m. For backlink tracking, check Linkody starting at 13€/m.

If you are serious about building a long-lasting web presence, you’ll eventually need one of the shiny big tools. Good luck finding your dream SEO toolbox, I’m still constantly tweaking mine!