Stablecoins have won: they’re the backbone of DeFi liquidity, the unit of account for onchain trades, and the most outward-facing DeFi usecase. By every adoption metric, they’re the most successful primitive we’ve built. And yet, something went wrong. The dominant stablecoin models have drifted from their original promises. What started as experiments in decentralized money has quietly become a collection of TradFi dependencies wrapped in smart-contract aesthetics. The foundations deteriorated as the TVL climbed. The most popular stablecoins remain tokenized T-Bills that do not forward their yield, namely USDC and USDT.

It’s time for me to get out of stealth and reveal a project that’s been cooking for 2 years: Polaris. But before we get there, I want you to understand my “Vitalik set out to build the world computer after his WoW warlock got nerfed” moment. Two stories illustrate the pattern I described: both are protocols I’ve watched closely. They started with novel premises, and ended up somewhere else entirely.

Once a Pigeon, Forever a Pigeon

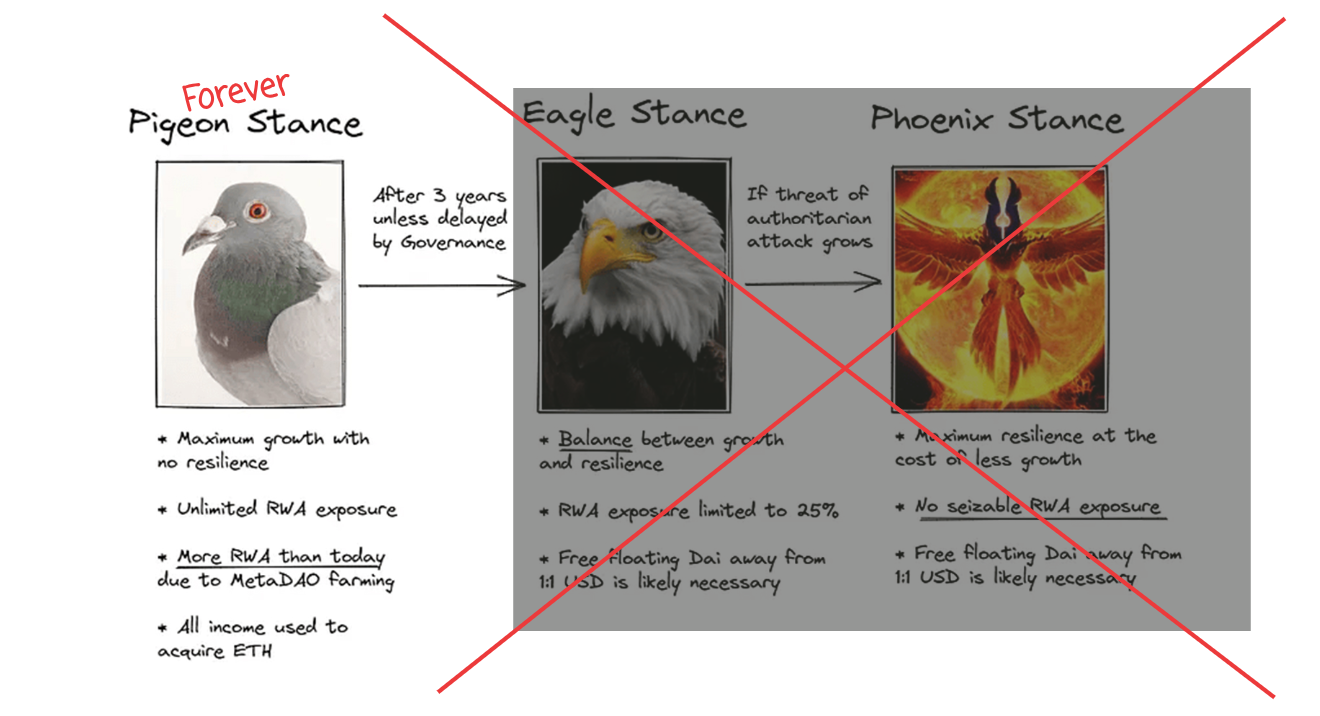

In 2022, Rune Christensen presented MakerDAO’s Endgame Plan: a strategic roadmap for the protocol’s evolution. It was structured around three “stances,” each representing a different balance between growth and resilience.

- Pigeon Stance: Maximum growth with no resilience. Unlimited RWA exposure. All income is used to acquire ETH. This was explicitly described as the fragile phase—necessary for bootstrapping, but not a destination.

- Eagle Stance: A transition point. RWA exposure capped at 25%. Balance between growth and resilience. The plan said this would come “after 3 years, unless delayed by Governance.”

- Phoenix Stance: The endgame. Maximum resilience. No seizable RWA exposure. A stablecoin that could survive authoritarian pressure because it had nothing to seize.

Phoenix Stance was the promise, and the Pigeon Stance a necessary compromise to fulfill it. It’s now 2026, and Maker is still extremely RWA-dependent, in Pigeon Stance. Governance delayed the transition indefinitely. The escape clause built into the plan (“unless delayed by Governance”) became the permanent state.

DAI is now overwhelmingly backed by real-world assets. The transition to USDS was also an opportunity to add blacklisting and freezing features: DAI/USDS became USDC with extra steps. The protocol that pioneered decentralized stablecoins is operationally dependent on the traditional financial system it was supposed to circumvent.

The Pigeon never learned to fly.

The Silent Pivot

Ethena launched USDe with a compelling narrative: a stablecoin generating yield from the basis trade. Delta-neutral positions across spot and perpetual markets. The pitch was clean, and made accessible to all a trade that used to be much more demanding and complex to implement.

Then, market conditions changed. After October 10 2025, basis trade yields compressed. The spread that funded USDe’s returns narrowed to levels that couldn’t sustain the promised yield. Ethena had a problem. USDe quietly shifted the yield source and began sourcing returns from tokenized T-bills, using pyUSD. The onchain, crypto-native yield engine became yet another T-bill wrapper.

Yet most USDe holders did not realize. Go around and ask people where they think USDe’s yield is coming from, and they still reply almost automatically, “basis trade”. And they were right ~6 months or more ago when they deposited into it, but they’re now holding exposure to tokenized treasuries. The black box changed its contents, the label stayed the same, and very few realized what happened.

To me, this is the perfect example of the counterparty risk, which is by its very nature dual:

- The one most people understand: you are assuming the risk of that counterparty defaulting, failing, etc.

- The more subtle consequence of the first: when that counterparty that you accepted is offchain, it’s a black box. It can change. You are not just trusting today’s counterparty. You are trusting every future decision the operators might make: you are writing a blank check when it comes to your risk exposure.

The counterparty risk is virtually infinite as soon as you accept it.

A Design Problem, Not a People Problem

I’m not here to attack Rune or the Ethena team. Both managed to grow the biggest alternatives to USDC and USDT, which command respect. They made rational decisions within the constraints they faced. When yield compresses, you find new yield. When governance wants growth, you give them growth.

The core problem is the architecture. When yield depends on external sources, you’re renting your model. The moment those sources change: basis compresses, RWA regulations tighten, counterparties fail, your stablecoin changes with them. You don’t control your own foundations.

“Decentralized governance” sounds resilient until you realize it’s the mechanism by which protocols abandon their original constraints. The DAO votes to compromise, and the compromise becomes permanent.

These are not lone stories, it’s usual business. Projects start decentralized, and scale into dependency. The outcome is predictable, but end users end up holding something different from what they signed up for.

What Polaris Is Built to Be

This is not a product announcement; the protocol isn’t live yet. What I want to share with you today is a set of commitments: architectural decisions that are load-bearing and not-negotiable, so you know what to expect from Polaris.

Counterparty-free by architecture, not by promise.

Polaris generates yield from volatility through a bonding curve mechanism. No RWAs. No CEX exposure. No external yield pipelines that can compress, pivot, or get seized. The system creates its own yield from the asset it’s built on. We are looking to build a protocol that can seriously scale; thus, a self-referencing yield is the only way to ensure growth potential, regardless of its current scale.

Immutable core.

The foundational logic of Polaris cannot be changed. Not “won’t be changed pending governance approval.” Cannot. The core mechanics are fixed at deployment. This is a constraint we’re imposing on ourselves, and on everyone who comes after. When you interact with Polaris, you’re interacting with the same system tomorrow that you’re interacting with today. The “black box” here is made of glass, enabling you to see that the core never denatures.

Stewardship, not governance.

POLAR token holders don’t govern Polaris in the traditional sense. They steward it.

What’s the difference? Governance implies the power to change anything, including the things that shouldn’t change. Stewardship means something narrower: the ability to adjust parameters within hard-coded ranges and direct resources to steward the protocol growth. POLAR holders can help the protocol adapt to changing market conditions. They cannot denature it. They cannot vote to add RWA exposure. They cannot dismantle the immutable core. The boundaries are enforced by code, not by social consensus.

This is a “governance” that is clearly defined and knows its limits. It’s quite unusual and so remote from the usual “governance”, that we decided to explicit its nature with a new name: “stewardship”.

The Shape of the System

I’ll keep this brief—detailed mechanics are coming over the following weeks. But here’s the structure:

Three tokens:

- pUSD: A yield-bearing stablecoin backed by pETH collateral

- pETH: An ETH derivative with a rising price floor, created through the bonding curve

- POLAR: The stewardship token, capturing real yield from protocol activity

Three engines:

- A bonding curve that converts ETH deposits into pETH, capturing volatility as yield

- A CDP architecture optimized for stability and growth, allowing pUSD borrowing against pETH

- A conversion mechanism where POLAR is minted exclusively through pETH burning, raising the collateral floor

The engines reinforce each other. As the system grows, collateralization strengthens. Yield scales with adoption instead of diluting. The flywheel is designed to accelerate, not plateau.

More details soon. For now, understand that the architecture serves the philosophy, not the other way around.

The Call

Polaris isn’t live. You are early. For now, the best place to learn about Polaris is the website and the most eager can already join our Telegram announcement channel.

I’ve spent years writing about DeFi, analyzing protocols, watching the compromises accumulate, and the promises evaporate. If you’ve seen stablecoins abandon their foundations and felt something was wrong, you understand why we’re here. If you believe that decentralization is a property of architecture, not marketing, you understand what we’re building.

I’m not looking for users yet. I’m looking for people who get it.

Polaris is not just yet another DeFi protocol: it’s DeFi’s immune system eruptive answer to the USDC/T virus. We’ve been in the trenches for too long to see the space we’ve dedicated our lives to end up captured, tamed and neutralized like the Internet was. To other teams, this is just a job, an occupation; another yield source. To us, this is the Final Boss: if we fail here, we would have been just another set of pawns furthering a global agenda further vassalizing the world’s populations: our main life arc defeated, erased, neutered. We want to see trustless DeFi survive us, and be harnessed by our grand kids.

Uncensorable financial services, just like privacy, are necessary weapons in the coming wars against Mega Corps/Govs, and we can’t to leave our soldiers unequipped. We don’t intend to be pawns, but rather to design the board on which the resistance fights. How serious are we? McAfee-level serious we take this stable to a 10-digit supply in two years. Unlike him, thanks to our immutable code, we won’t need to go on the run; but we’re damn ready for it if that increase the success odds. Locked in poorly describes how born-and-self-made-ready we are for this.

I’m not alone in this; I am just one out of an elite team, led by a man I worked with for more than two years at the DeFi Collective. I saw him grow and thrive in DeFi, never defaulting on his principles: he’s more than ready for his main character arc, and you’ll be seeing him a lot more of him in the coming weeks and months: Robert/0xLuude.

Explore the vision: polarisfinance.io

Stay informed: Follow Polaris on Twitter

I’ve barely scratched the surface of Polaris here, so if you like where this is heading, check the website and join the Telegram to further your understanding.

Until then, remember that promises quickly turn into compromises if not enforced by immutable code.

- TokenBrice, finally entering his founder arc, ready to unleash half a decade of stablecoin autism.