AMM

Slippage

Definition

Slippage refers to the difference between the expected price of a trade and the actual executed price. It occurs when there's insufficient liquidity or high volatility, causing the price to move unfavorably during trade execution.

Example

Example

You try to buy $10,000 worth of a token at $100, but due to slippage, you end up paying an average of $102 per token.

Risks to Consider

Risks

- Higher costs than expected

- Front-running

- Sandwich attacks

Common Questions

How can I minimize slippage?

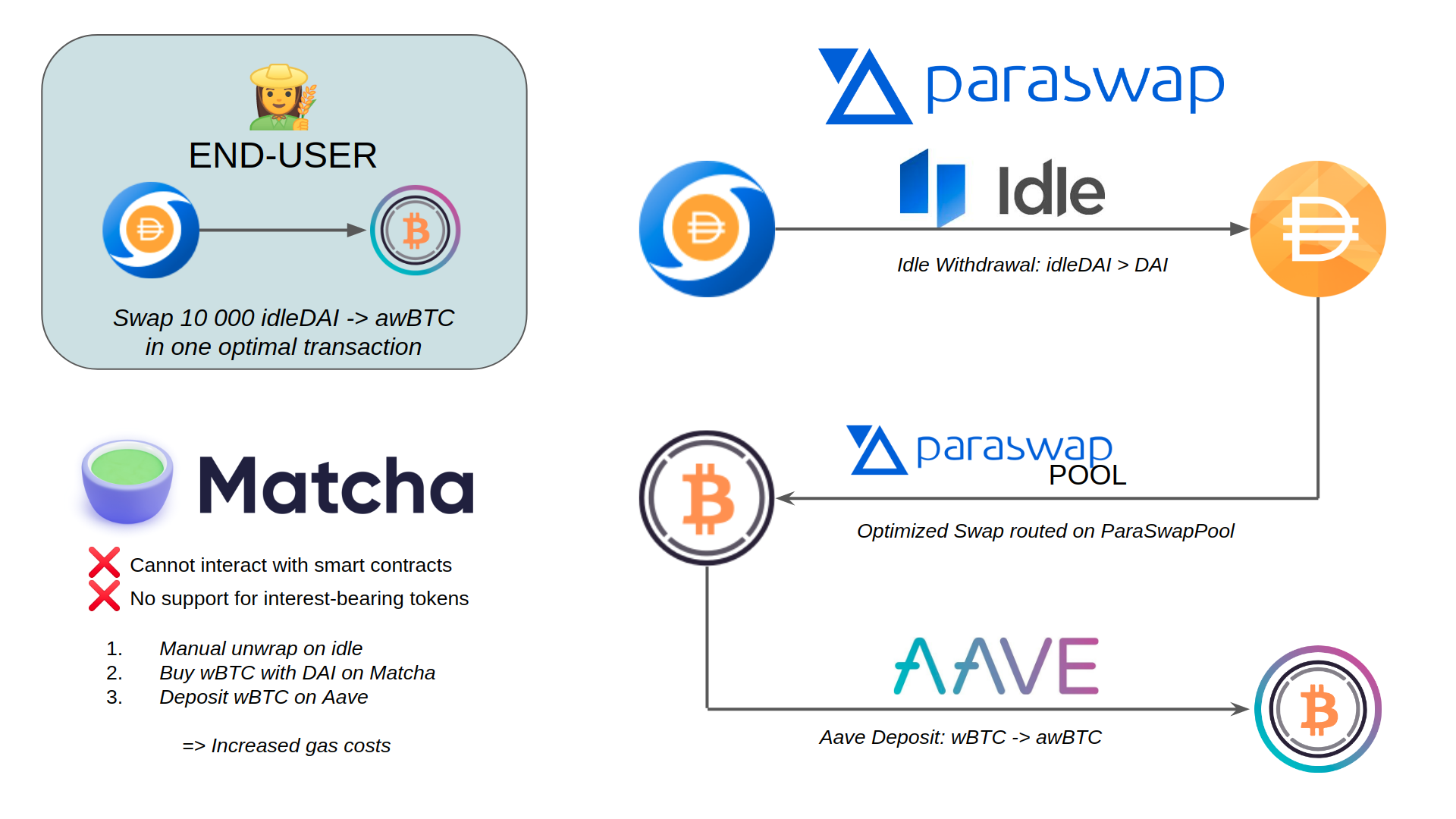

Trade smaller amounts, use liquid pairs, set appropriate slippage tolerance, or **use aggregators** that find the best routes.