🔄 PROTOCOLS & PLATFORMS

Money Market

Definition

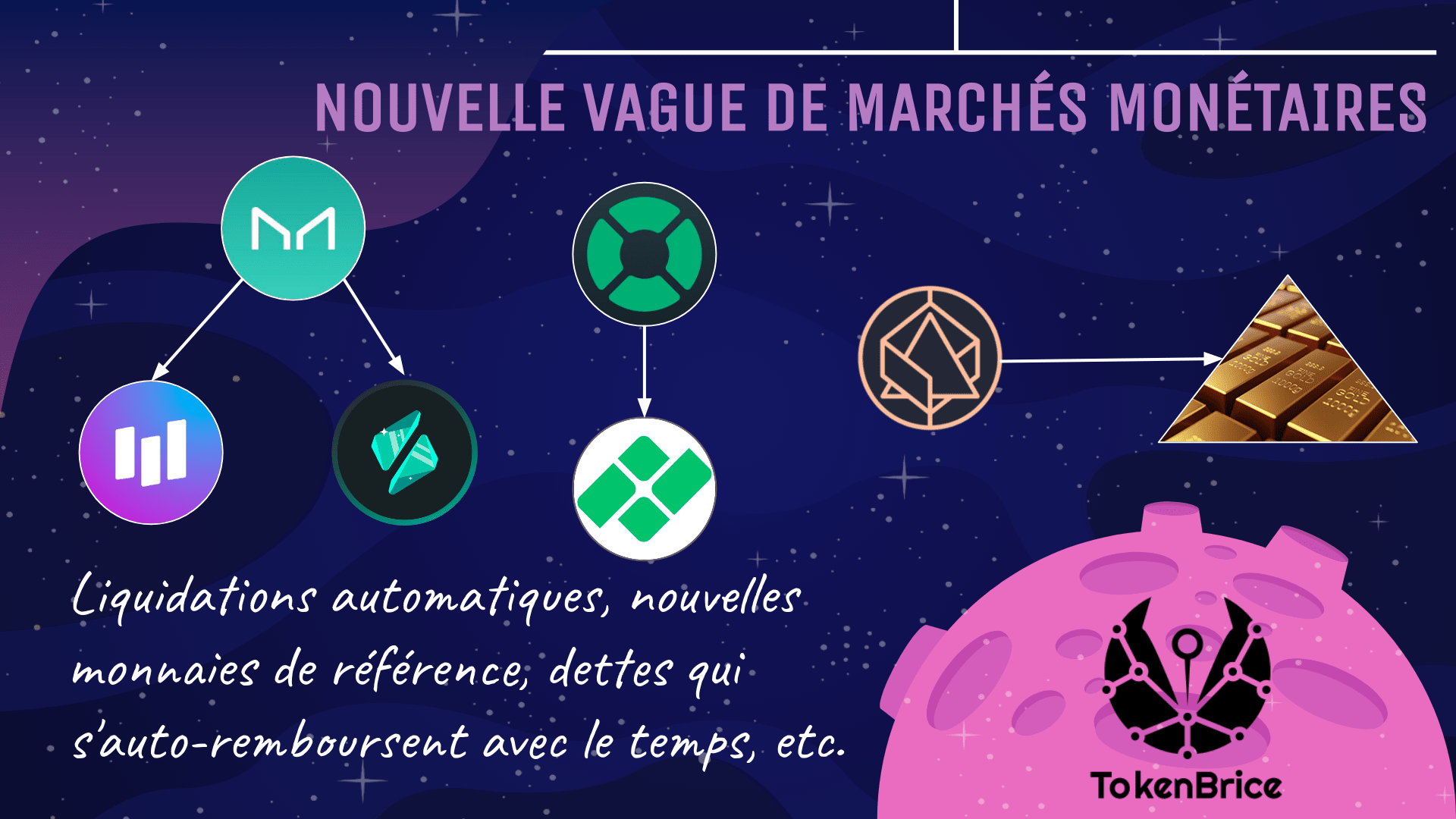

In DeFi, a money market is a protocol that facilitates lending and borrowing of crypto assets through smart contracts. Lenders deposit assets into pools and earn interest, while borrowers provide collateral and pay interest to access funds. Major money markets include Aave, Compound, and Morpho. They are foundational DeFi primitives that enable leverage, hedging, and yield generation.

Example

Example

On Aave, you deposit 10 ETH as collateral and borrow 5000 USDC at variable interest. The ETH earns deposit interest while you pay borrowing interest on the USDC.

Risks to Consider

Risks

- Smart contract risk

- Liquidation risk

- Interest rate volatility

- Oracle manipulation

Common Questions

How do DeFi money markets differ from traditional ones?

DeFi money markets are permissionless, non-custodial, and operate 24/7 via smart contracts. Interest rates adjust algorithmically based on supply/demand. Anyone can lend or borrow without approval.