CDP (CDP (Collateralized Debt Position))

Definition

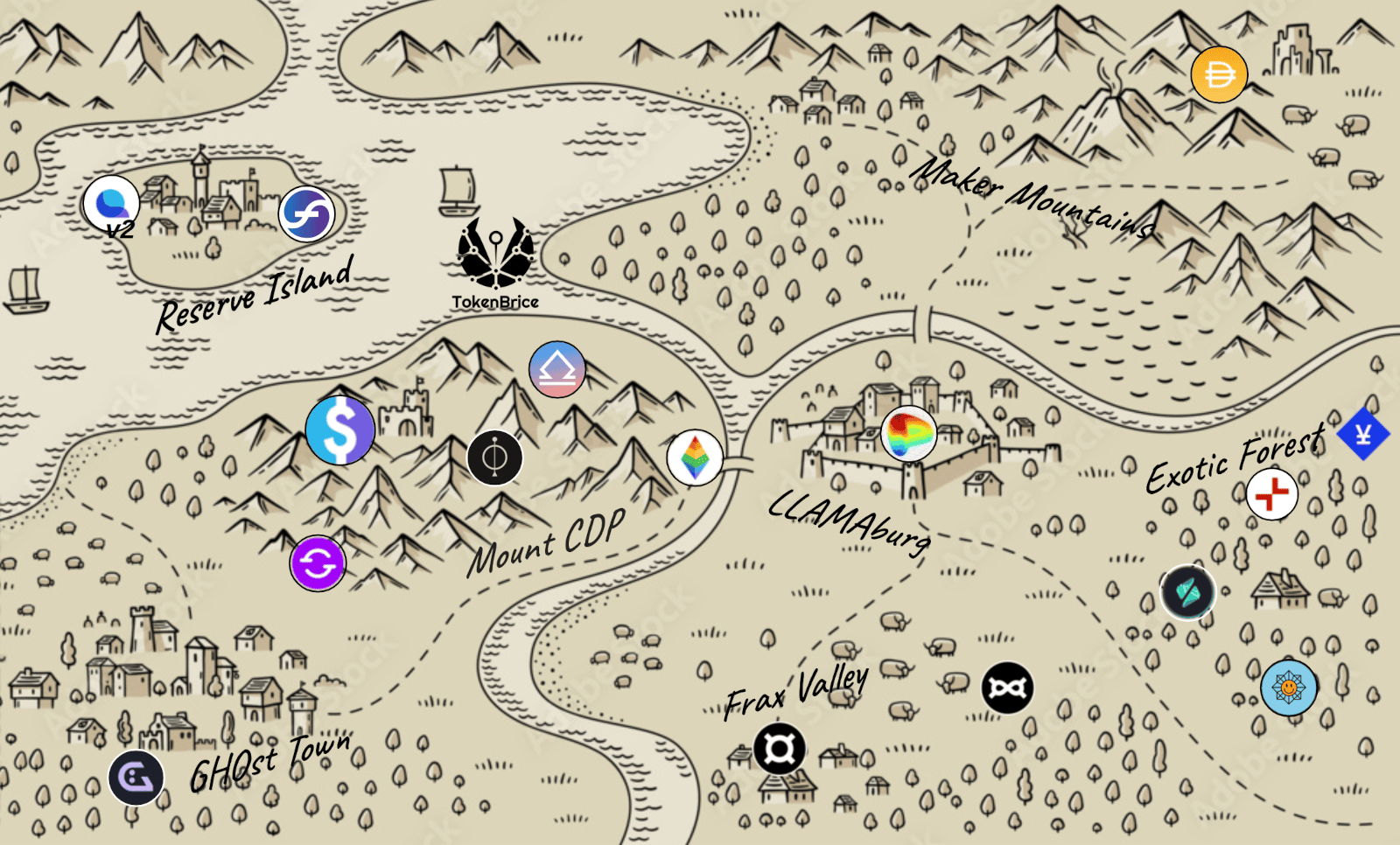

A Collateralized Debt Position (CDP) is a smart contract where a user deposits collateral to mint or borrow stablecoins. Popularized by MakerDAO (deposit ETH, mint DAI), CDPs are the backbone of decentralized stablecoins and on-chain lending. The position must remain overcollateralized or it gets liquidated. CDPs enable leverage, stablecoin minting, and capital-efficient borrowing.

Example

On MakerDAO, you open a CDP by depositing $3000 of ETH and minting 1500 DAI (200% collateralization). If ETH drops and your ratio falls below 150%, your position is liquidated.

Risks to Consider

- Liquidation risk

- Collateral volatility

- Smart contract risk

- Stability fee changes

Common Questions

What's the difference between a CDP and a regular loan?

A CDP lets you mint new stablecoins against your collateral, while a regular DeFi loan borrows existing assets from a lending pool. CDPs create new supply; lending pools redistribute existing supply.